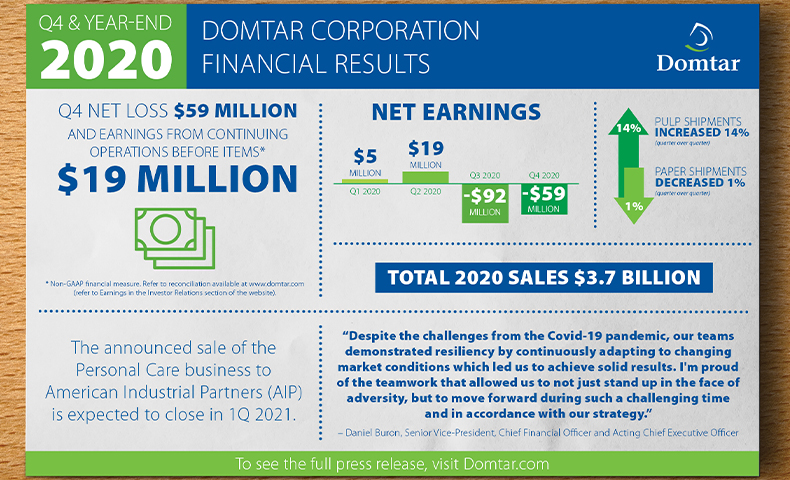

Domtar today reported a net loss of $59 million ($1.07 per share) for the fourth quarter of 2020 compared to a net loss of $92 million ($1.67 per share) for the third quarter of 2020, and a net loss of $34 million ($0.59 per share) for the fourth quarter of 2019. Sales for the fourth quarter of 2020 were $0.9 billion.

The fourth quarter 2020 results include an after-tax loss of $43 million ($0.78 per share) from discontinued operations related to the announced sale of the Personal Care Business, compared to earnings of $19 million ($0.34 per share) for the third quarter of 2020 and earnings of $10 million ($0.17 per share) for the fourth quarter of 2019.

Excluding discontinued operations and the items¹ listed in the full media release, the Company had earnings from continuing operations before items¹ of $19 million ($0.34 per share) for the fourth quarter of 2020, compared to loss from continuing operations before items¹ of $1 million ($0.02 per share) for the third quarter of 2020 and loss from continuing operations before items¹ of $9 million ($0.16 per share) for the fourth quarter of 2019.

Fiscal Year 2020 Highlights

For fiscal year 2020, net loss amounted to $127 million ($2.29 per share), compared to net earnings of $84 million ($1.37 per share) for fiscal year 2019. The Company had earnings from continuing operations before items¹ of $1 million ($0.02 per share) for fiscal year 2020, compared to earnings from continuing operations before items¹ of $149 million ($2.43 per share) for fiscal year 2019. Sales were $3.7 billion for fiscal year 2020.

“Despite the challenges from the Covid-19 pandemic, our teams demonstrated resiliency by continuously adapting to changing market conditions which led us to achieve solid results. I’m proud of the teamwork that allowed us to not just stand up in the face of adversity, but to move forward during such a challenging time and in accordance with our strategy. We met many goals last year; we prioritized maximizing cash, reducing costs, and remaining an agile, reliable partner to our customers. We believe these changes will improve this Company for the long-term,” said Daniel Buron, senior vice president, chief financial officer and acting chief executive officer.

Quarterly Review

“Our paper shipments were in line with the third quarter and order activity remained stable across all channels, while paper pricing was consistent with the year-to-date average. In Pulp, we improved our cost performance, which is attributable to lower maintenance costs, our cost reduction program and favorable wood costs. Market fundamentals continue to improve, and we announced several pulp price increases in the first quarter of 2021.”

Mr. Buron added, “In Personal Care, we had a strong finish to the year with improved fourth quarter performance driven by strong sales of adult incontinence products in North America and a good performance in Europe following the seasonality impact of the softer summer period. We announced the sale of the Personal Care Business to American Industrial Partners for $920 million, and we expect the transaction to close in the first quarter of 2021.”

Operating loss was $20 million in the fourth quarter of 2020, compared to an operating loss of $152 million in the third quarter of 2020. Depreciation and amortization totaled $53 million in the fourth quarter of 2020.

Operating income before items¹ (list in full media release) was $35 million in the fourth quarter of 2020, compared to an operating income before items¹ of $27 million in the third quarter of 2020.

The decrease in operating loss in the fourth quarter of 2020, compared to the prior quarter, was the result of lower long-lived asset impairment and closure and restructuring charges related to the cost savings program, lower maintenance costs, favorable productivity and lower selling, general and administrative expenses. These factors were partially offset by lower volume in pulp and paper, lower average selling prices for pulp, higher freight and other costs and unfavorable exchange rates.

When compared to the third quarter of 2020, manufactured paper shipments were down 1% and pulp shipments increased 14%. The shipment-to-production ratio for paper was 98% in the fourth quarter of 2020, compared to 105% in the third quarter of 2020. Paper inventories increased by 10,000 tons and pulp inventories decreased by 3,000 metric tons when compared to the third quarter of 2020.

Liquidity and Capital Resources

Cash flow from operating activities was $135 million and capital expenditures were $45 million, resulting in free cash flow¹ of $90 million for the fourth quarter of 2020. Domtar’s net debt-to-total capitalization ratio¹ stood at 26% at December 31, 2020, compared to 28% at September 30, 2020.

For fiscal year 2020, cash flow from operating activities was $411 million and capital expenditures were $175 million, resulting in free cash flow¹ of $236 million.

We will resume our share buyback program following this earnings release. The timing, method and amount of stock repurchases will depend on a variety of factors, including the market conditions, as well as corporate and regulatory considerations. The share buyback program may be suspended, modified or discontinued at any time, and the Company has no obligation to repurchase any amount of its common stock under the program.

Outlook

In 2021, paper demand remains uncertain and dependent upon the Covid-19 recovery, in particular quarantine measures impacting the return to office and school. We expect near-term pulp markets to gradually improve driven by better demand, maintenance outages and restocking in China. Overall raw material costs are expected to moderately increase and freight costs are also expected to be higher.